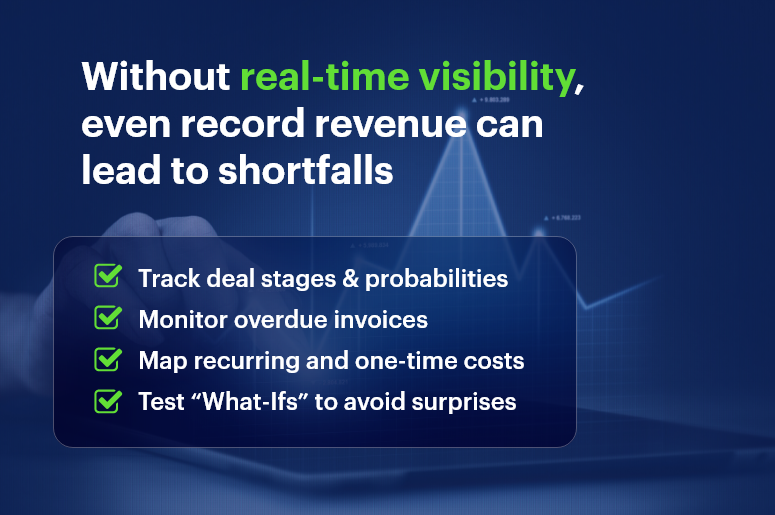

Picture this: you’re hitting record sales — but still facing a cash crunch. Shockingly, 60% of SMBs report revenue without visibility, which leads you to cash flow visibility issues. Without it, you’re essentially flying blind, risking late payroll, deferred supplier payments, or halted investments.

Fortunately, this lack of insight won’t last forever. In this post, we’ll show you how CRM-driven sales forecasting, invoice integration, and financial planning can transform your bottom line. You’ll learn to leverage pipeline data, track unpaid invoices, and anticipate cash gaps — all while using CRMLeaf’s unified CRM + ERP platform. By the end, you’ll confidently plan ahead, align teams, and keep cash flowing smoothly.

Why Cash Flow Visibility Is Essential

Growing businesses often juggle multiple systems: one for sales, another for invoices, and still another for payroll. This fragmentation hides critical insights. Consequently:

- Payroll & staffing depend on predictable inflows; sudden shortfalls disrupt operations.

- Supplier payments get delayed, causing late fees or strained partnerships.

- Growth decisions, like marketing spend or hiring, remain tentative without a clear runway.

This challenge spans industries:

- Professional services face unpredictable billing cycles — billing delays don’t halt payroll.

- Manufacturers pay for raw materials upfront but only invoice later.

- Tech/SaaS firms often charge clients annually or quarterly but must still run payroll monthly.

Clearly, cash flow visibility is vital — not just for finance but for overall business resilience. With CRMLeaf’s CRM + ERP platform, you unify pipeline forecasting, invoicing, payments, and expense management. That gives you real-time clarity — no more manual spreadsheets.

Best Practices for Improving Cash Flow Visibility

Here are actionable steps to enhance cash flow visibility, and how CRMLeaf can simplify each:

1. Track Pipeline & Sales Forecasts

- Hold weekly opportunity reviews with probabilities and close dates.

- Use automated weighted forecasting to translate pipeline stages into revenue estimates.

- Sync these forecasts into your cash planning dashboard.

CRMLeaf advantage: Your pipeline forecast feeds directly into cash flow projections, giving you a real-time cost-to-cash view.

2. Integrate Invoicing & Payment Data

- Automatically trigger invoices upon deal closure.

- Monitor payment statuses: paid, pending, or overdue.

- Project future inflows using payment terms like Net-30.

CRMLeaf advantage: Seamless invoice integration ensures accuracy and saves manual effort.

3. Forecast Cash Outflows: Expenses & Payroll

- Log recurring costs like payroll, rent, and utilities.

- Forecast upcoming expenses and align them with inflows.

- Spot mismatches early before they affect liquidity.

CRMLeaf tip: Module integration lets you view expense records alongside pipeline, ensuring true visibility.

4. Run “What-If” Scenarios

- Simulate late payments, project delays, or extra hires.

- Adjust priorities based on cash impact.

- Build contingency buffers.

CRMLeaf tool: “What-if” scenario planning lets you toggle variables and view new cash positions instantly.

5. Establish a Cash Forecasting Cadence

- Hold weekly cash standups to highlight delays or variances.

- Sync monthly with finance, sales, ops, and HR teams.

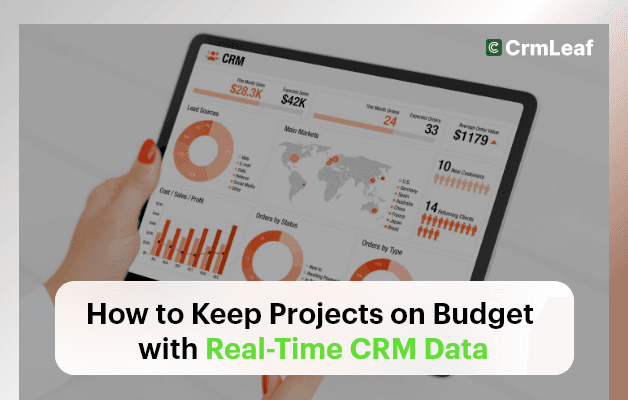

- Use visual dashboards to track runway and reserve levels.

CRMLeaf dashboard: Intuitive visual indicators enable teams to spot and fix shortfalls immediately.

Customer Success: EverGrow Consulting

EverGrow Consulting struggled with unpredictable billing cycles. After integrating CRMLeaf:

- They tracked pipeline forecasts and invoices simultaneously.

- They logged payroll and expenses in one dashboard.

- They ran early detection scenarios for anticipated shortfalls.

Result: Cash runway extended from 2 weeks to 8 weeks. When a $50k delay surfaced, they adjusted milestones, delayed a hire, and avoided an overdraft. EverGrow credited CRMLeaf’s cash flow visibility for transforming financial planning and decision-making.

Key Takeaways

With strong cash flow visibility, you gain the foresight to plan strategy, hiring, and expenses before cash constraints emerge. By combining pipeline forecasting, invoice status tracking, and expense integration, you build a live cash picture that empowers all departments.

With CRMLeaf’s unified CRM + ERP solution, you get forecasting tools that are:

- Accurate

- Automated

- Collaborative

- Actionable

So stop flying blind. Get the cash clarity you need to grow.

FAQs

Q: What is cash flow visibility?

A: It’s the ability to track and forecast cash coming in and going out, in real-time — avoiding surprises.

Q: Why is pipeline forecasting important?

A: Because it turns stage-based sales data into actual cash projections, giving you early warning alerts.

Q: Can small teams implement these practices?

A: Absolutely. CRMLeaf’s scalable modules support teams of any size without complex setup.

Q: How do I start improving cash flow visibility?

A: Begin by syncing sales pipeline to cash dashboards, connect invoice data, and forecast expenses weekly.