Taxation is one of the trickiest aspects of running a business. It’s not just about calculating numbers — it’s about interpreting laws, staying compliant, and making sure no one pays more tax than they should. For businesses, tax compliance is about avoiding penalties. For individuals, it’s about making the most of exemptions. And for consultants, it’s about balancing accuracy, compliance, and trust — all at once.

At CrmLeaf, we work closely with payroll managers, accountants, and tax consultants across industries. We’ve seen firsthand how small mistakes — like a missed PF contribution, late TDS payment, or miscalculated HRA — can create massive problems. That’s why we believe we are in the best position to explain the real challenges consultants face and how automation can solve them.

This isn’t just a generic list. This is a comprehensive guide, backed by real scenarios, examples, and solutions.

The Top 10 Challenges of Tax Consultants

Here are the 10 biggest hurdles tax consultants face every day:

- Ever-Changing Tax Laws and Regulations

- Time-Consuming Manual Calculations

- Complex Payroll Components (PF, ESI, TDS, Professional Tax)

- Managing Multiple Clients at Once

- Ensuring 100% Compliance

- Handling Errors and Penalties

- Data Security and Confidentiality

- Client Miscommunication and Missing Documents

- Peak Season Workload Pressure

- Staying Updated with Technology and Automation

Detailed Breakdown of Each Challenge

1. Ever-Changing Tax Laws and Regulations

Tax laws are constantly evolving. Consultants must be aware of:

- Budget announcements

- CBDT (Central Board of Direct Taxes) circulars

- EPFO and ESIC notifications

- GST amendments

- State-level changes like professional tax updates

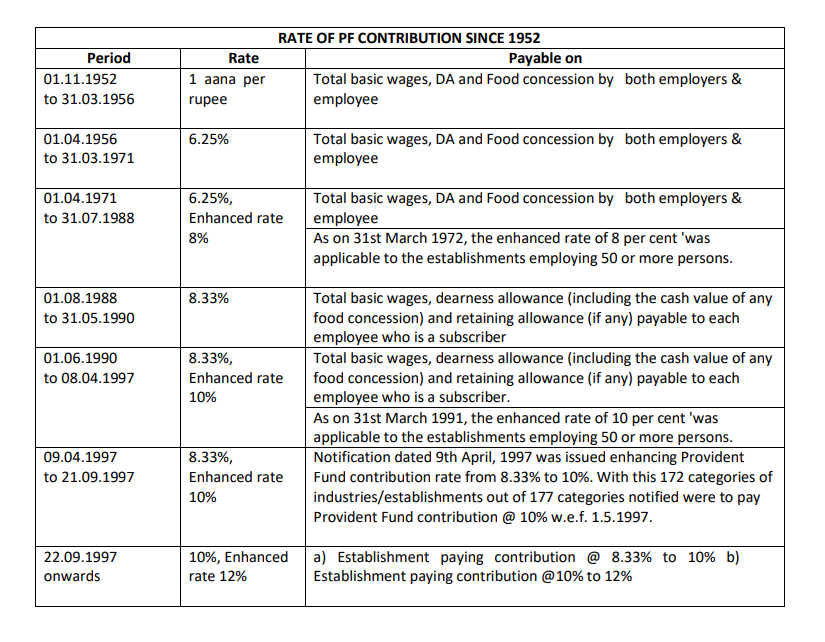

For example, in 2023, the EPF wage ceiling increased, impacting how PF contributions were calculated for employees with higher salaries. Overnight, consultants had to adapt to this change, recalculate contributions, and update payroll systems.

The challenge? Missing even one update can mean incorrect filing, penalties, and angry clients. Consultants spend hours reading government notifications and updating spreadsheets — time that could be spent on client advisory.

2. Time-Consuming Manual Calculations

Manual tax calculation is like walking on a tightrope. Every number must match. One wrong formula in Excel could throw off an entire payroll file.

A tax consultant managing payroll for 100 employees manually has to calculate:

- PF for each employee (employer + employee share)

- ESI where applicable

- TDS based on slabs, exemptions, and rebates

- Professional Tax based on the state

- Any arrears, bonuses, or deductions

This process can easily take 2-3 days every month — and that’s assuming no errors. If errors are found, it means re-checking everything.

Automation reduces this burden, but many consultants still rely on outdated methods because they’re afraid of moving away from Excel.

3. Complex Payroll Components

Each payroll component has its own formula, limits, and exceptions.

- PF (Provident Fund): 12% of Basic + DA. But some employers cap their contribution at ₹15,000 salary ceiling, while others don’t.

- ESI: Only applicable if gross salary ≤ ₹21,000/month. Both employer and employee contributions differ.

- TDS: Calculated on annualized salary after deductions like HRA, 80C, etc. Each employee may have a different TDS liability.

- Professional Tax: Varies by state. In Karnataka, it’s ₹200/month for a salary > ₹15,000. In Maharashtra, slabs are different.

For consultants managing employees across different states and industries, this complexity becomes a huge challenge.

4. Managing Multiple Clients at Once

Tax consultants rarely work with one client. They may be handling:

- A manufacturing company with 200 workers

- A startup with 15 employees

- Freelancers needing annual filings

- A mid-sized IT firm with PF, ESI, and GST requirements

Each client has different needs, deadlines, and rules. One client might demand a PF challan today, while another needs revised TDS returns tomorrow. Managing all this requires time-blocking, task prioritization, and reliable systems.

Without automation, consultants spend more time firefighting than planning.

5. Ensuring 100% Compliance

Tax is all about deadlines:

- PF/ESI payments: 15th of every month

- TDS payments: 7th of every month

- GST filing: 10th, 20th, or 24th (depending on scheme)

- Annual filings and returns: strict dates

If a consultant misses a deadline, even by a day, the client pays penalties and interest. That damages both trust and reputation.

The compliance burden becomes heavier during financial year closing when multiple filings overlap. Consultants live under constant pressure to meet these dates without errors.

6. Handling Errors and Penalties

Even with the best intentions, errors happen:

- Wrong HRA exemption claimed

- Incorrect PAN/TAN details in TDS filing

- Salary components misclassified

When this happens, consultants spend hours preparing revised returns, rectifications, and reconciliation. Not only is this frustrating, but clients often blame consultants — even if the mistake was due to missing data from the client.

7. Data Security and Confidentiality

Tax consultants handle highly sensitive data:

- Employee salary details

- PAN, Aadhaar, bank accounts

- Tax returns and IT acknowledgments

In an era of cyber threats, storing this data in Excel files, emails, or unsecured systems is dangerous. A single breach could mean loss of trust, legal action, and permanent damage to reputation.

Clients expect consultants to follow data privacy best practices, which is tough without professional-grade tools.

8. Client Miscommunication and Missing Documents

Consultants often rely on clients to submit:

- Investment proofs

- Salary breakup details

- Rent receipts for HRA

- Loan repayment documents

The reality? Clients often delay, forget, or send incomplete files. This leads to last-minute rushes, incorrect calculations, and missed deadlines.

For example, if a client shares investment proofs after TDS filing, the consultant must re-do calculations and file corrections. This eats into valuable time.

9. Peak Season Workload Pressure

Tax consultants have two types of seasons: normal workload and chaotic workload.

During filing season (July for IT returns, March for FY closing), consultants may work 12–14 hours daily just to meet deadlines. Stress levels rise, mistakes increase, and burnout becomes real.

Without proper systems, tax consultants feel like they’re constantly “catching up” rather than being in control.

10. Staying Updated with Technology and Automation

Technology is moving fast. Payroll and compliance software now automate PF, ESI, TDS, GST, and reporting. Consultants who adopt these tools become more efficient.

But many still hesitate due to:

- Lack of training

- Fear of making mistakes in a new system

- Cost concerns

The truth? Clients prefer consultants who are tech-enabled. They expect real-time reports, digital pay-slips, and error-free compliance. Falling behind in tech means losing clients to modern competitors.

How PF is Calculated (with Example)

Provident Fund (PF)

Provident Fund (PF)

Both employer and employee contribute 12% of Basic + DA.

Example:

- Employee Basic Salary = ₹20,000

- Employee PF = 12% of 20,000 = ₹2,400

- Employer PF = 12% of 20,000 = ₹2,400

- Total PF = ₹4,800 per month

If the company caps PF wages at ₹15,000:

- Employee PF = 12% of 15,000 = ₹1,800

- Employer PF = ₹1,800

Various Types of PF Deduction Calculation

Provident Fund (PF) may look straightforward on paper — 12% of basic salary + DA by both employee and employer — but in reality, PF deduction varies depending on company policy, government limits, and employee category. Here are the different scenarios:

1. Standard PF Deduction (12% of Basic + DA)

- Employee contribution = 12% of Basic + DA

- Employer contribution = 12% of Basic + DA

- Widely followed in most organizations.

Example:

Basic Salary = ₹20,000

- Employee PF = ₹2,400

- Employer PF = ₹2,400

- Total = ₹4,800

2. Capped PF Deduction (on ₹15,000 wage ceiling)

As per EPF Act, PF can be calculated only up to ₹15,000 of wages, unless the employer chooses to contribute above this. Many companies follow this cap to reduce cost.

Example:

Basic Salary = ₹25,000

- Employee PF = 12% of ₹15,000 = ₹1,800

- Employer PF = ₹1,800

- Total = ₹3,600

3. Voluntary Provident Fund (VPF)

Employees can choose to contribute more than 12% of their basic salary to PF. Employer contribution remains capped at 12%.

Example:

Basic Salary = ₹30,000

- Employee decides to contribute 20% = ₹6,000

- Employer still contributes 12% = ₹3,600

- Total PF = ₹9,600

4. Employer Contribution Split (EPF + EPS)

Employer’s 12% contribution doesn’t go entirely to EPF. A part goes into EPS (Employee Pension Scheme).

- 8.33% of Basic (max ₹1,250/month) → EPS

- Remaining → EPF

Example:

Basic = ₹15,000

- Employer 12% = ₹1,800

- EPS (8.33% of 15,000) = ₹1,250

- Balance (₹550) goes into EPF

5. Exempted Establishments (PF Trusts)

Some organizations run their own PF Trusts, where contributions are managed internally instead of EPFO. While the calculation percentages are the same, returns and management may differ. Consultants must handle compliance differently here.

6. International Worker PF Rules

For employees working in India but from countries with Social Security Agreements (SSA), PF rules may differ. Contributions can be higher, and withdrawal rules are stricter.

Why Does This Matters for Consultants?

Each PF scenario requires different calculations, challans, and reporting. Mistakes here can lead to:

- Over/under deduction of PF

- Employee dissatisfaction

- Non-compliance penalties from EPFO

That’s why tax consultants must be crystal clear on which PF deduction type applies to which employee.

Other Payroll Calculations (with Example)

ESI

- Employee contribution = 0.75% of gross

- Employer contribution = 3.25% of gross

If gross = ₹18,000:

- Employee: ₹135

- Employer: ₹585

- Total = ₹720

TDS

Based on tax slabs.

Example: Annual salary ₹6,00,000

- Less: Standard Deduction = ₹50,000

- Taxable = ₹5,50,000

Tax:

- 0 – 2.5L = Nil

- 2.5 – 5L = 5% = ₹12,500

- 5 – 5.5L = 5% of ₹50,000 = ₹2,500

- Total Tax = ₹15,000/year (₹1,250/month)

Professional Tax

Varies by state.

- Maharashtra: ₹200/month for salaries above ₹10,000

- Karnataka: ₹200/month for salaries above ₹15,000

Compliance Calendar FY 2025-26

Staying compliant is easier when you have a clear roadmap. Our Compliance Calendar for FY 2025-26 highlights key GST, TDS, Tax, and Regulatory deadlines to help businesses and compliance professionals file on time, avoid penalties, and streamline processes.

What is a Compliance Calendar?

A compliance calendar is a one-stop guide for CFOs, Compliance Officers, and Company Secretaries to track important filing deadlines across GST, Income Tax, Company Law, and Labor Laws. It saves time, reduces risk, and ensures no critical date is missed. Our calendar is updated regularly — so bookmark it and check back often.

September, 2025

October, 2025

November, 2025

December, 2025

January, 2026

February, 2026

March, 2026

Regulatory Compliance Calendar

Beyond tax, businesses must comply with Labor Laws and Company Law requirements.

Important Deadlines:

- ESI Contribution Payment: 15th of every month

- Professional Tax Payment: 15th of every month (varies by state)

- Service Tax Returns (ST-3): 25th of the month following the quarter

- Filing of Annual Return (Form MGT-7): Within 60 days of AGM

- Filing of Financial Statements (Form AOC-4): Within 30 days of AGM

- Stamp Duty Payment: As per state laws/transactions

How to Stay Compliant & Avoid Penalties

- Track all deadlines in one place – Use the compliance calendar as your single source of truth.

- Automate and reconcile – Auto-file returns and match data with GSTR-2B, 26AS, and books.

- Stay updated – Watch for changes in GST, TDS, MCA, and Income Tax rules.

- Validate before filing – Cross-check PAN, GSTIN, challans, and invoices.

- Centralize & train teams – Store compliance data securely and upskill staff.

EPFO Default Surge and Its Implications for Businesses

Managing PF contributions isn’t just about numbers — it’s about staying compliant with the Employees’ Provident Fund Organization (EPFO).

When companies fail to deposit contributions on time, they risk not only penalties but also becoming part of India’s growing default statistics.

The Historic Surge in EPFO Defaults

According to official EPFO data (2023–24):

- Total defaults reached ₹25,820.88 crore, a 69.3% jump from ₹15,254.06 crore in 2022–23.

- Private sector unexempted establishments accounted for the largest chunk with defaults worth ₹13,734.85 crore.

- Public sector establishments defaulted on ₹2,252.27 crore, while cooperatives owed ₹362.58 crore.

- Exempted establishments saw arrears rise to ₹5,318.42 crore, a massive 243.7% increase compared to the previous year.

State-Wise Concentration of Arrears

Defaults are not evenly spread. A few states account for the lion’s share of arrears from exempted establishments:

- Telangana: ₹3,505.84 crore

- Delhi: ₹213.52 crore

- West Bengal & Sikkim: ₹145.26 crore

- Jharkhand: ₹135.66 crore

- Rajasthan: ₹115.85 crore

Together, these states alone contribute to over 92% of the total arrears.

Why These Defaults Happen

Many of these defaults fall into the “Not Immediately Realizable (NIR)” category, meaning the amounts are stuck in:

- Court or tribunal disputes

- Liquidation cases

- Rehabilitation schemes

- Instalment-based recovery plans

In fact, 57.9% of total defaults (₹9,474 crore) were marked as NIR.

The Strict Response from EPFO

To counter rising defaults, EPFO has directed regional offices to:

- Publicly display the top 10 defaulters on notice boards and websites.

- Attach movable and immovable properties of defaulting establishments.

- Work with state police for enforcement.

- Designate civil prisons to expedite recovery from chronic defaulters.

What This Means for Businesses and Consultants

For businesses, defaulting on PF payments is not just a financial setback — it’s a reputational risk. With names being published, properties attached, and stricter enforcement, compliance is non-negotiable.

For tax consultants, this surge highlights the critical role of timely and accurate PF calculation, deduction, and deposit. One missed deadline or error can expose clients to legal battles and massive arrears.

This is why many consultants now prefer automated systems like CrmLeaf Payroll, which:

- Auto-calculates PF contributions with caps and splits (EPF + EPS).

- Tracks payment deadlines.

- Generates challans and compliance-ready reports.

- Minimizes the chance of default by removing human error.

How CrmLeaf Auto-Calculates PF & Other Payroll Components

With CrmLeaf, tax consultants can say goodbye to manual errors.

- PF, ESI, and PT are auto-calculated using built-in formulas.

- TDS updates happen automatically with the latest government slabs.

- Pay-slips are generated instantly with accurate deductions.

- Compliance-ready reports are just one click away.

- Clients get self-service access to pay-slips and tax docs — saving consultants hours of follow-ups.

This turns consultants into trusted advisors instead of number crunchers.

Conclusion

Being a tax consultant today is tough. Between changing laws, complex calculations, multiple clients, and peak season stress, the job can feel overwhelming. But it doesn’t have to be that way.

With automation tools like CrmLeaf Payroll, consultants can eliminate manual errors, stay compliant, and free up their time to focus on what really matters — advisory, strategy, and client relationships.

FAQs

1. What’s the hardest part of being a tax consultant?

Keeping up with constant law changes and ensuring 100% compliance while juggling multiple clients.

2. How is PF calculated?

12% of basic salary + DA, contributed by both employee and employer.

3. What makes payroll so complex?

Because it includes PF, ESI, TDS, and state-level professional taxes, all with different rules and limits.

4. How does CrmLeaf help consultants?

By automating calculations, reducing compliance risks, and generating instant reports.

5. Who can use CrmLeaf?

Individual consultants, small firms, and large companies — it’s scalable for everyone.